You can upload receipts for household bills such as utilities, phone services, insurance, and more. Debt Management Plan (DMP) payments are also supported by uploading a monthly Statement of Accounts. We don’t currently support credit card or loan payments.

Build credit

from bill receipts

Build credit, even while on a DMP

Pay bills on time, and

we'll help you get

credit for them.

Build credit history for

a better tomorrow.

How it works

-

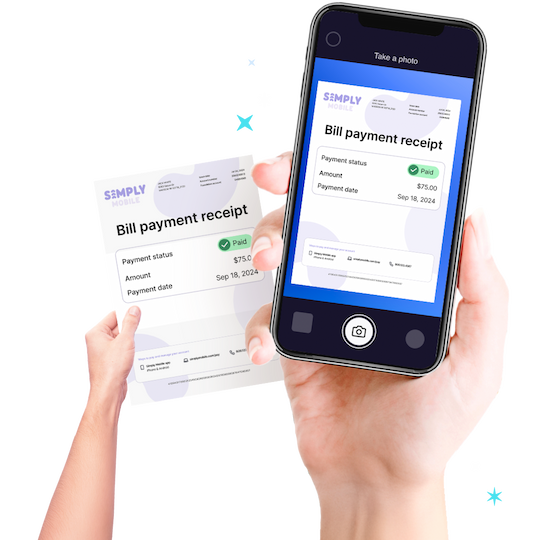

Upload a Bill Receipt

Take a picture of a recent bill receipt, or upload it. We’ll handle the rest. -

Confirm Your Details

Enter details to send your bill receipt to your credit file. -

Receipt reported!

Your bill receipt is reported to the major credit bureaus.

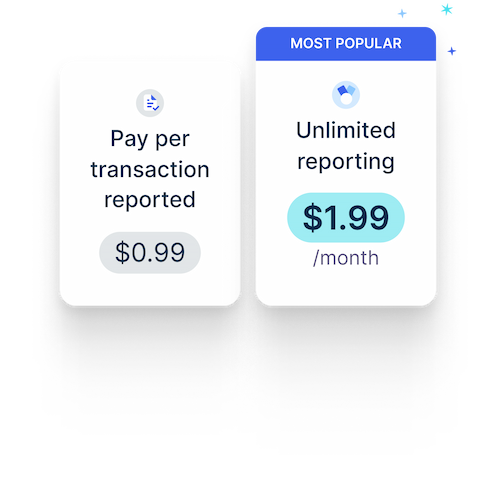

Clear & simple pricing

Frequently asked

questions

What types of bills can I upload?

How long does it take for my payment to be reported?

After you upload your first bill receipt, Pebble processes the payment within two weeks. Once processed, it may take a few additional weeks for the tradeline to appear on your credit report, as credit bureaus have varying update cycles.

Can this service help me improve my credit score?

While using Pebble Credit Reporter can positively impact your credit score, we cannot guarantee an improvement.

The effect on your score depends on a variety of factors, including your existing credit history, credit utilization, and other lines of credit. Equally, if you miss your payment with us, Pebble Credit Reporter can hurt your credit score.

Is my personal information safe?

Yes, your connection to and from Pebble is secured using 256-bit end to end encryption.

We conduct full security, compliance, and privacy audits regularly to make sure all your information is secure.

How do I know if my payment was successfully reported?

You will receive an email when your payment has been successfully processed. Pebble will charge your chosen payment method two weeks after your bill receipt upload. Please make sure you have sufficient funds to avoid negative reporting.

What happens if my credit score doesn’t change?

Everybody’s credit score profile is different; be patient and upload bill receipts consistently to give yourself the best chance of building payment history and improving your credit score.